Annual Gifting Amount 2025. Since this amount is per person, married couples have a total gift tax limit of $38,000. The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,990,000 for decedents who die in 2025,.

The exclusion will be $19,000 per recipient for 2025. If you purchase something from our posts, we may earn a small commission.

2025 Gift Amount Allowed William Bower, For 2025, the annual gift tax exclusion rises to $19,000.

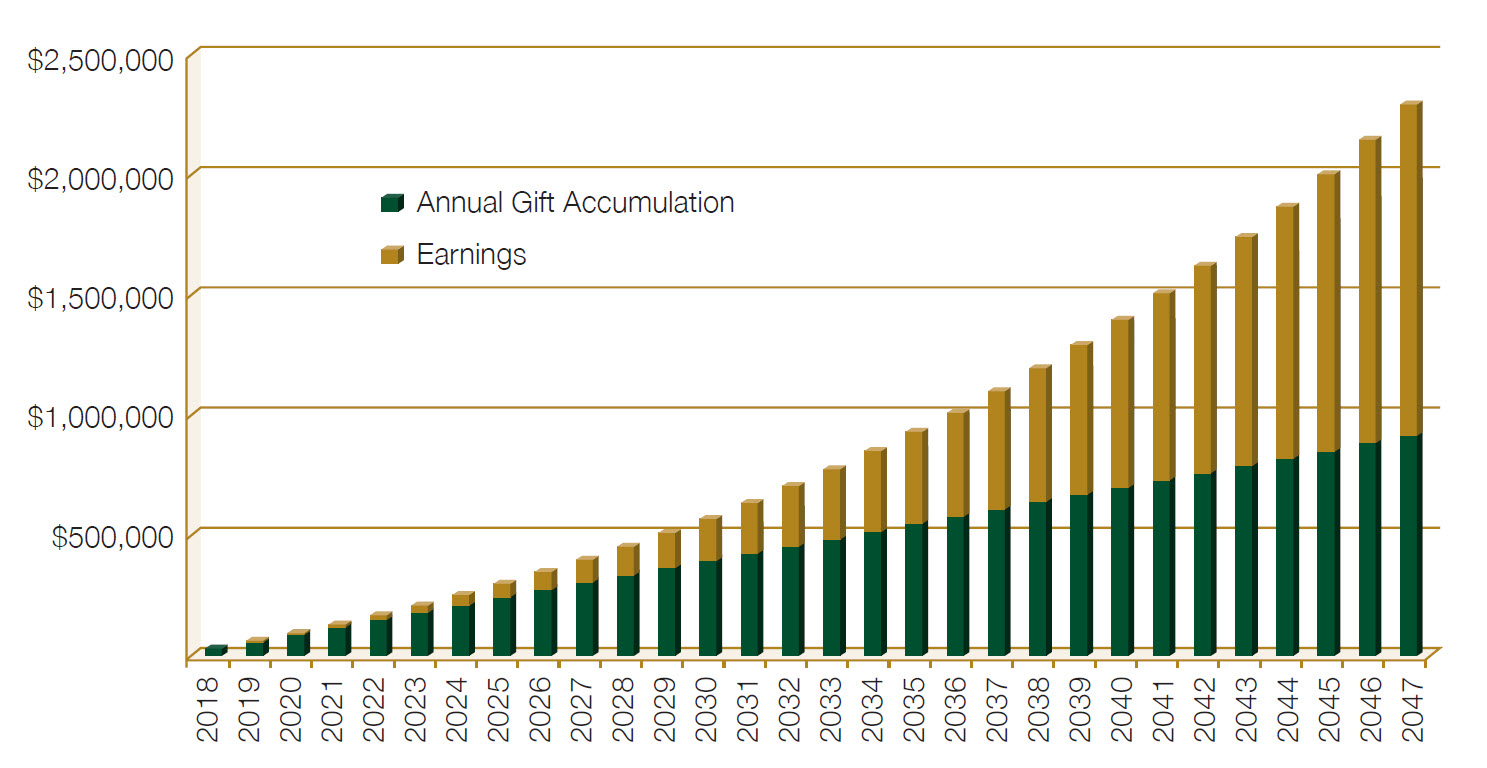

Annual Gift Tax Exclusion 2025 Amount Chart Emyle Francene, Clients are often interested in gifting to their loved ones not only to benefit the recipient of the gift, but also to reduce the donor’s taxable estate for estate tax purposes.

2025 Gift Exclusion Amount Etty Shanna, In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

All Inclusive Hawaii Vacation Packages 2025 All Inclusive. Free cancellation on select hotels bundle your […]

Ohio State Football Schedule 2025 Tv Times. 2025 ohio state football schedule is set. 2025 […]

New Illinois Employment Laws 2025. Following a busy 2025 session for the illinois legislature that […]